Asset allocation formula

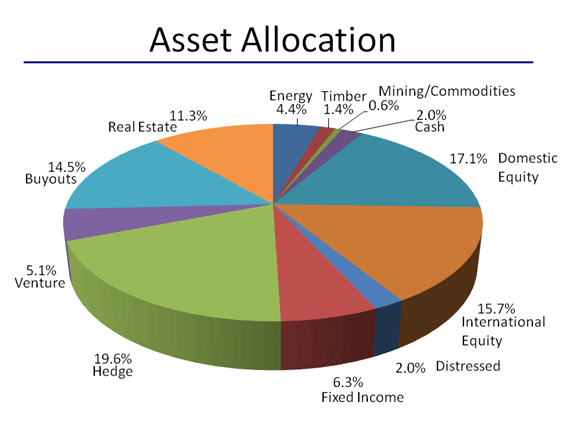

Age ability to tolerate risk and several other factors are used to calculate a desirable mix of. Strategic Asset Allocation This method establishes and adheres to a base policy mixa proportional combination of assets based on expected rates of return for each asset.

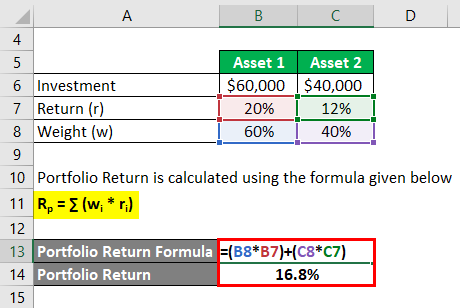

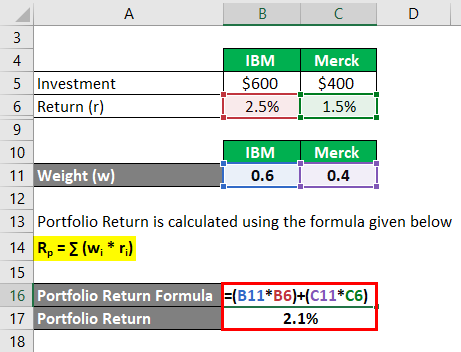

Portfolio Return Formula Calculator Examples With Excel Template

Following asset allocation formula To make your allocation decisions easier financial professionals have devised some standard formulas for dividing up your portfolio based on.

. Quality Asset Allocation Models For Investment Professionals. In the age-based asset allocation technique the investment decision is based on the age of the investor using the following formula. If you have 1000 in a pure stock fund and 1000 in a fund thats 60 in stocks and 40 in bonds you effectively have 1600 in stocks and.

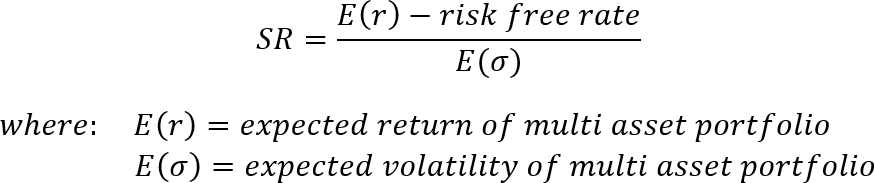

Asset allocation is the primary determinant explains 936 of the variation of a portfolios return. Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives. Think of it this way.

Ad Gain The Visibility you Need to Make Informed Decisions Based on Your Teams Workload. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments. Performance attribution or investment performance attribution is a set of techniques that performance analysts use to explain why a portfolios performance differed from the.

Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives. There are a few simple formulas to calculate asset allocation by age suitable for young beginners all the way to retirees and appropriate for multiple risk tolerance levels. Plan Prioritize Deliver Your Projects on Time.

Remember one of the most important things in investing is asset allocation. By this method a. Percentage of Equity in Portfolio 100 Age of Investor.

Asset Allocation by Age rule of thumb This rule of thumb states that your allocation to equities should be based on a formula of 100 minus your age. Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according. The security selection return results from deviations from benchmark weights.

The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark. Start Your Demo Today. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options.

Crafted by Experts and Designed to Capitalize on Ever-Changing Markets. Crafted by Experts and Designed to Capitalize on Ever-Changing Markets. If the investor allocated 25 to the risk-free asset and 75 to the risky asset the portfolio expected return and risk calculations would be.

ER of portfolio 3 x 25 10. Ad Position Market Products Construct Portfolios And Analyze Mutual Fund Ratings. Negative allocation effect indicates that the asset allocation decisions over the past 12 months whatever they were had a negative impact on the total portfolio performance.

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Portfolio Return Formula Calculator Examples With Excel Template

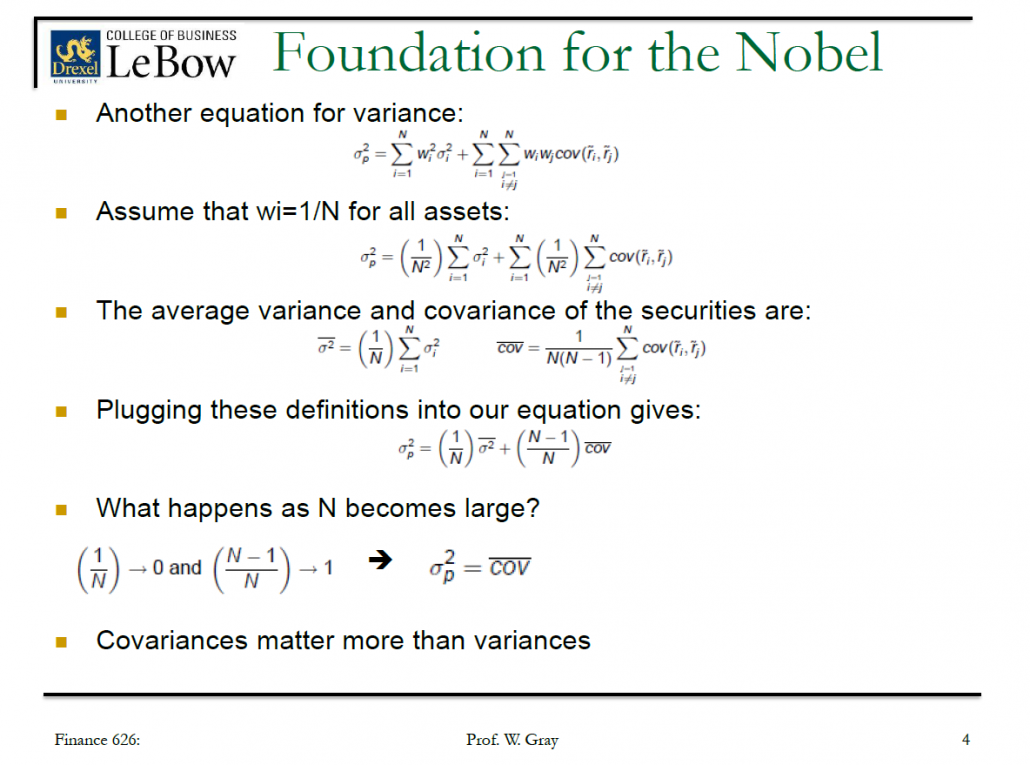

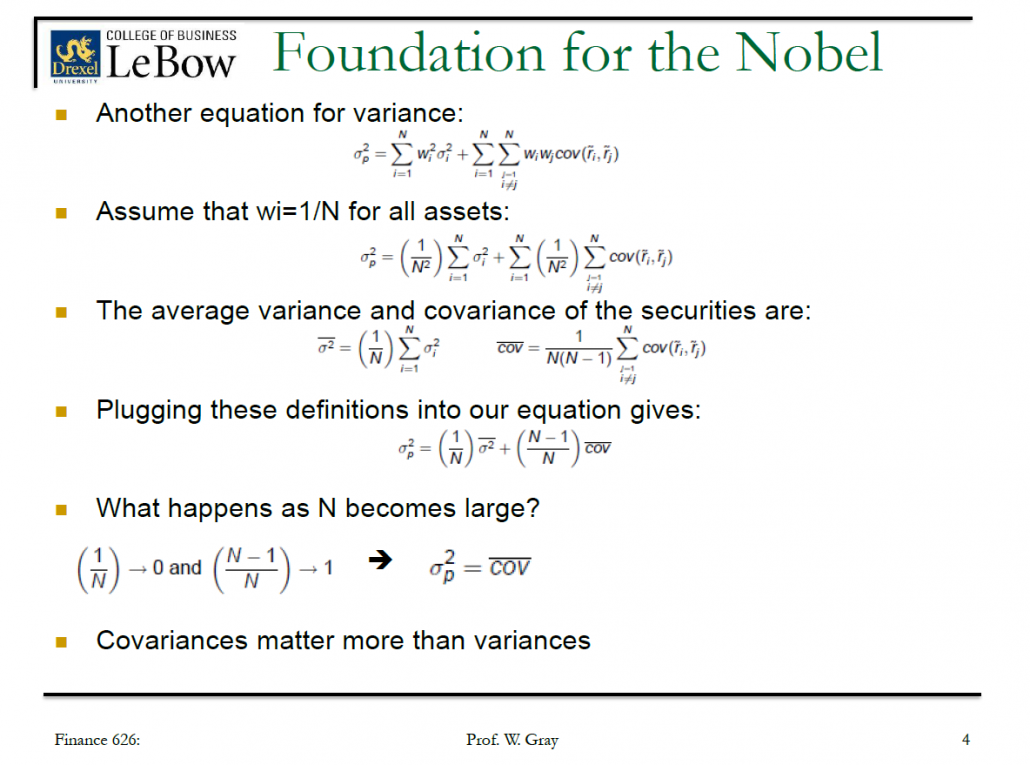

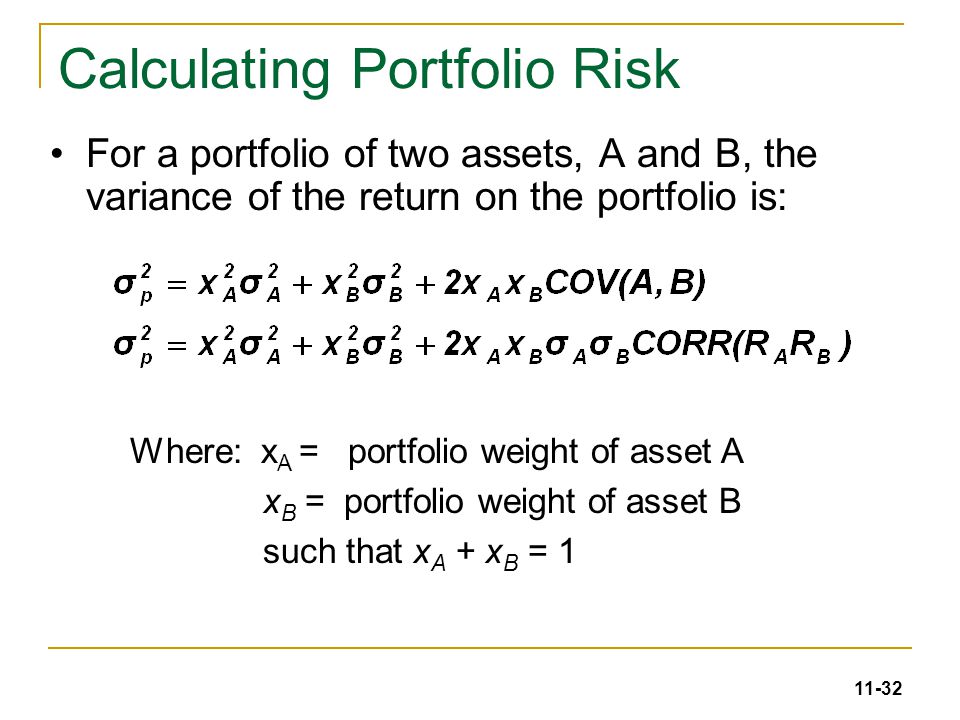

Chapter 5 Risk And Rates Of Return N

Standard Deviation And Variance Of A Portfolio Finance Train

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

Diversification And Risky Asset Allocation Ppt Video Online Download

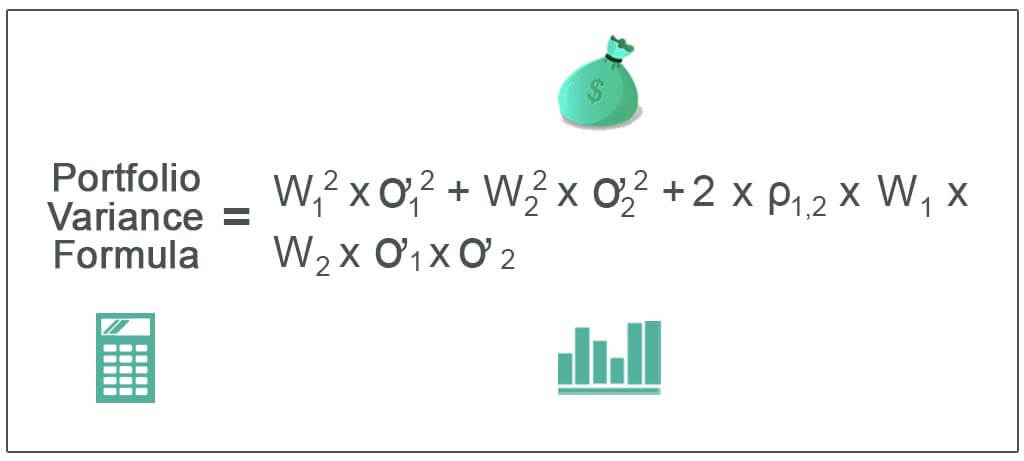

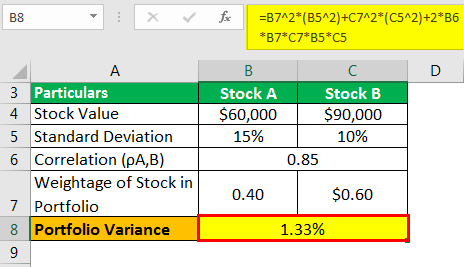

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Portfolio Return Formula Calculator Examples With Excel Template

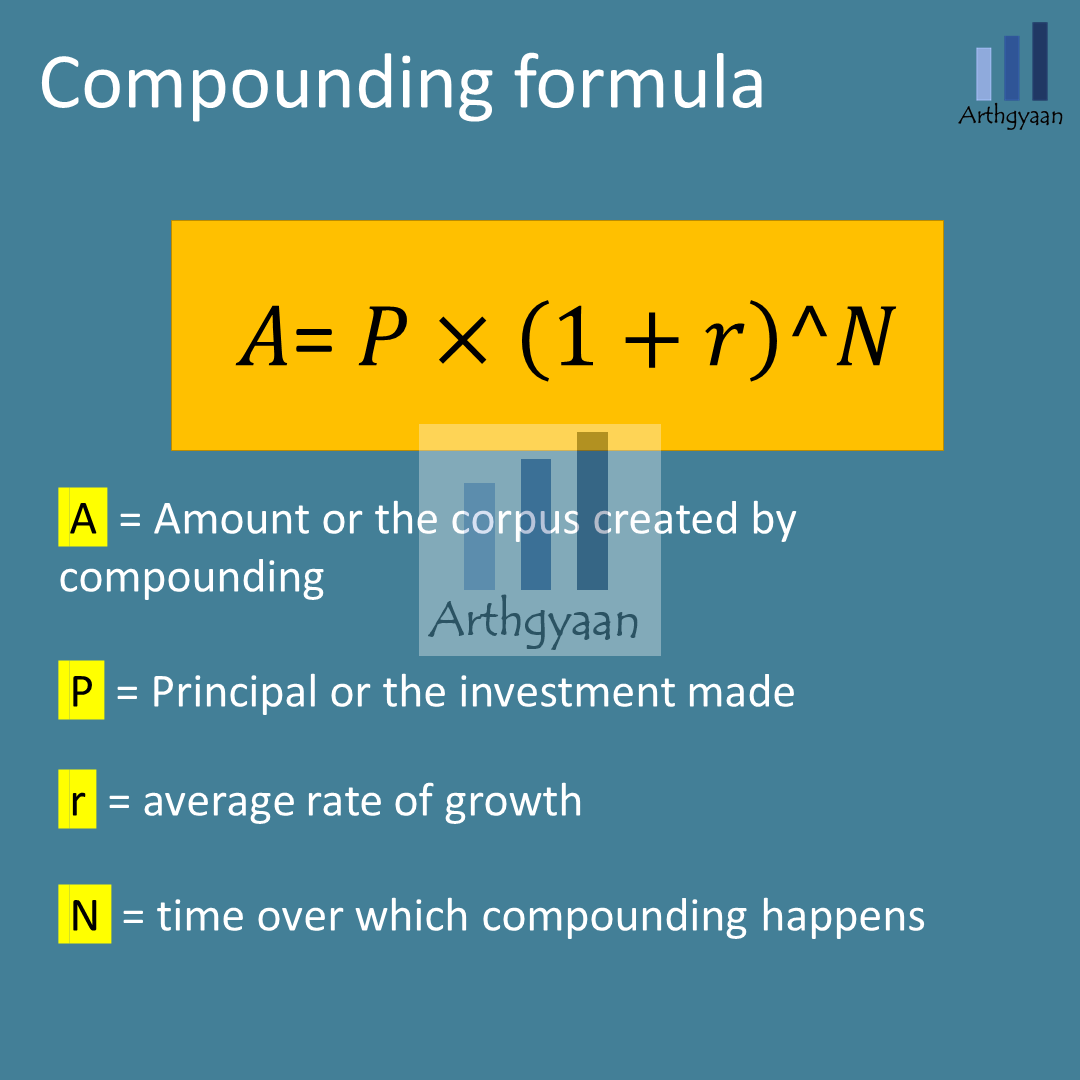

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

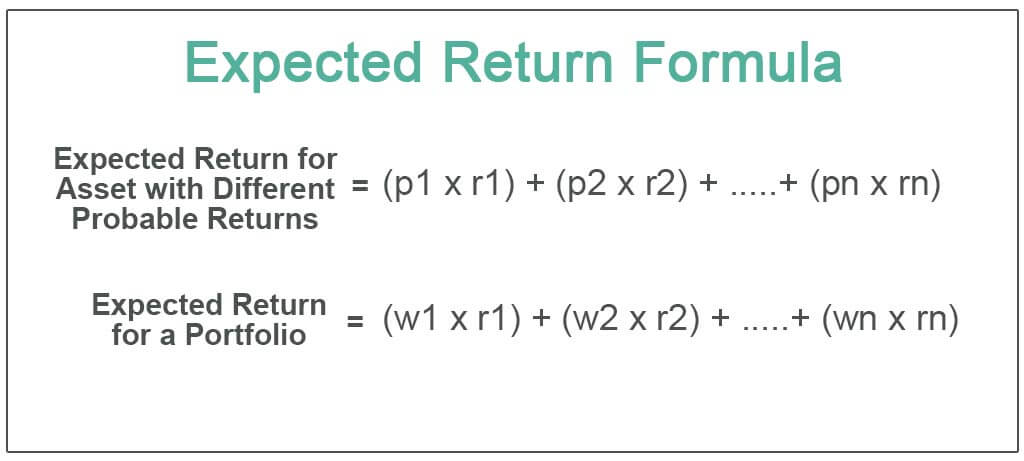

Expected Return Formula Calculate Portfolio Expected Return Example

Solactive Diversification The Power Of Bonds

Lower Risk By Rethinking Asset Allocation Seeking Alpha

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

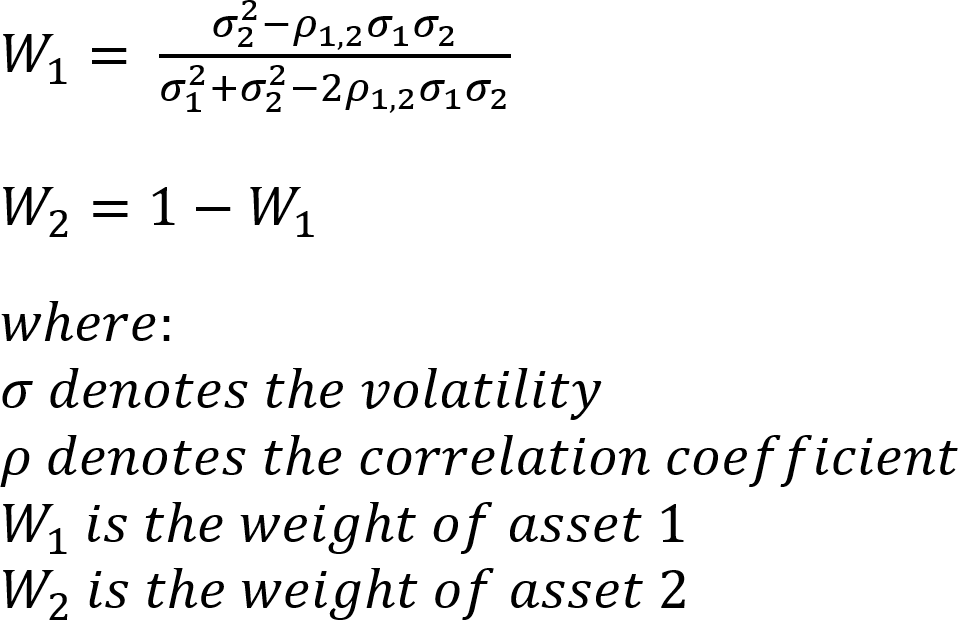

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Solactive Diversification The Power Of Bonds

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Portfolio Variance Formula Example How To Calculate Portfolio Variance